A FICO score is a credit score that is used by major credit bureaus to measure the credit standing of an individual. It is one of the most widely-used credit scoring systems in the world. FICO stands “Fair, Isaac, and Company”, which was named after the company that developed the software. It was founded in 1956 and named after its founders, Engineer Bill Fair and Mathematician Earl Isaac. The company began building a credit scoring system and started delivering it in 1970.

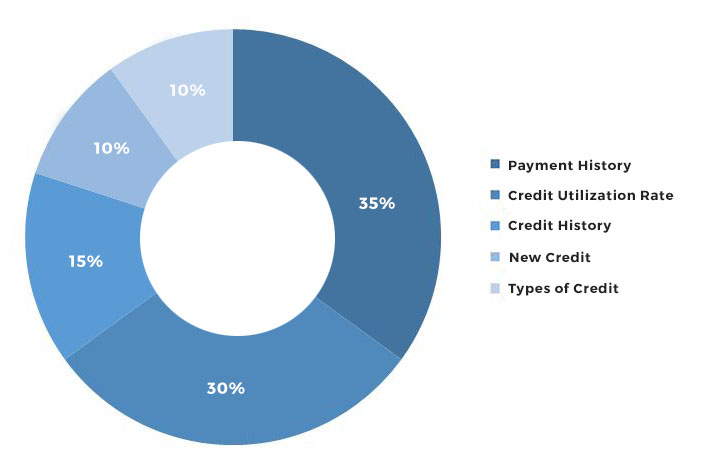

A FICO score is used to evaluate person’s credit risk and financial capability. Scored from numbers 300 (bad credit) and 850 (excellent credit), a higher score means you are of good credit standing and a lower score means you have a bad credit standing and is a financial risk. FICO collects credit information and uses it to create scores that help lenders determine the consumer’s behavior (if they can pay debts on time or they can handle a high credit limit).

If you are planning to apply for a credit card, a housing loan, or a car loan, banks will always refer to your credit scores given by FICO. They will assess your credit standing first before granting your application. Your score may vary depending on your credit reports. For example, having fewer debts can increase your credit score.

In order to qualify for the best credit terms, it is always advisable to pay debts on time. Avoid penalties and always maintain a good credit history.